ZENTEREST

Introduction#

ZENTEREST is a fork of both Compound Finance & Cream.finance, however, it will have its own unique set of listed assets, as well as an additional OM incentive distributed to suppliers/borrowers.

ZENTEREST offers an impressively wide range of assets to lenders and borrowers which the continue to expand. You can view the available

This beta version will initially be launched with unlocked OM rewards starting next week on Monday, January 4th in order to attract LPs and increase the platform’s TVL (Total Value Locked). However, in time, these rewards will be distributed through a rewards distribution smart contract vested over an extended timeframe. Initially, ZENTEREST will be launched as an Ethereum-based protocol, but as we continue with our tech development and roadmap, we will look to bridge this product to other interoperable blockchains, such as the Polkadot ecosystem in order to allow a multitude of assets to be listed.

Disclaimer: This project is in Beta. ZENTEREST contracts are a fork of Compound Finance & Cream.finance in its current form and hence are only as secure as Compound Finance’s and Cream.finance’s contracts and the underlying infrastructure. Users are advised to be informed and use the platform at their own risk.

Supplying Collateral#

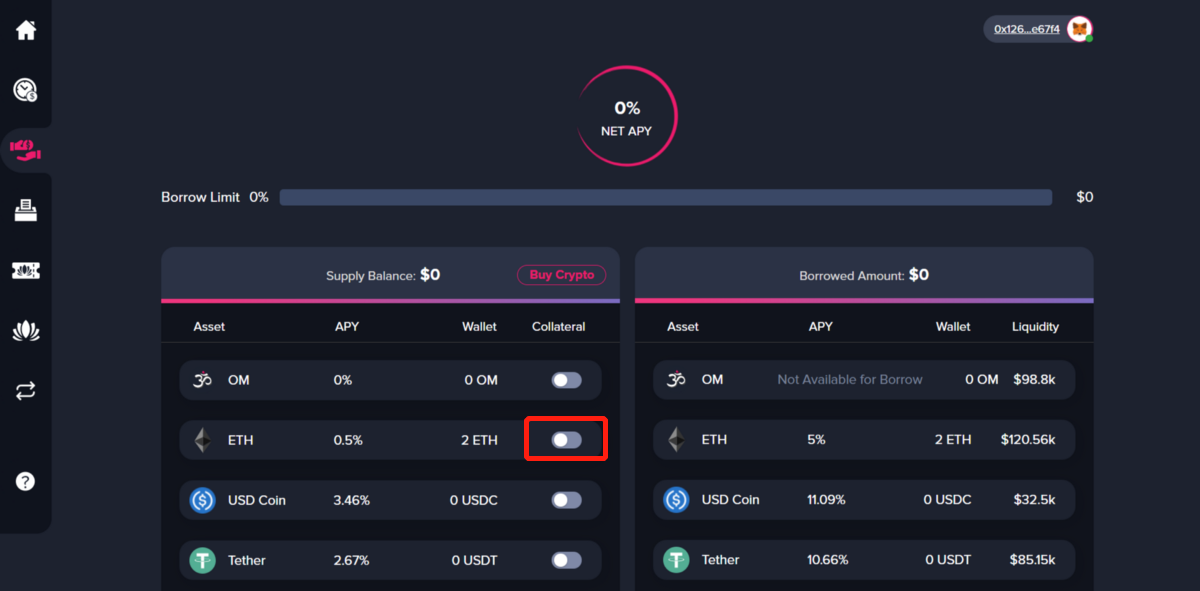

- From the main page of the app, find the asset which you wish to supply, and click on the switch to approve ZENTEREST to use that asset. For this example, we are using ETH.

- Click through the dialog box which pops up .

- Complete the transaction to approve ZENTEREST to use your selected asset with your browser extension wallet when it pops up.

- Wait until the transaction is confirmed on chain.

- After confirmation, you can now see that the pink toggle shows ETH has been approved for ZENTEREST to use, and you are ready to start the transaction to supply ETH liquidity. Click on “ETH” to begin the transaction.

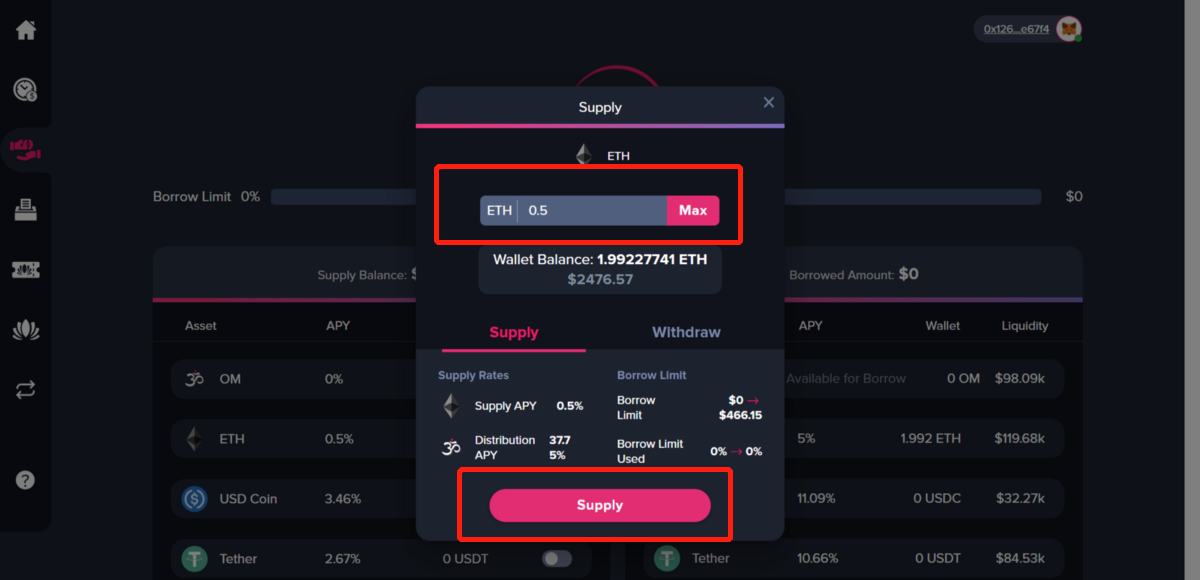

- Enter the amount of collateral you would like to supply in the input box which pops up and click the “Supply” button.

- Complete the transaction in your browser extension wallet when it pops up.

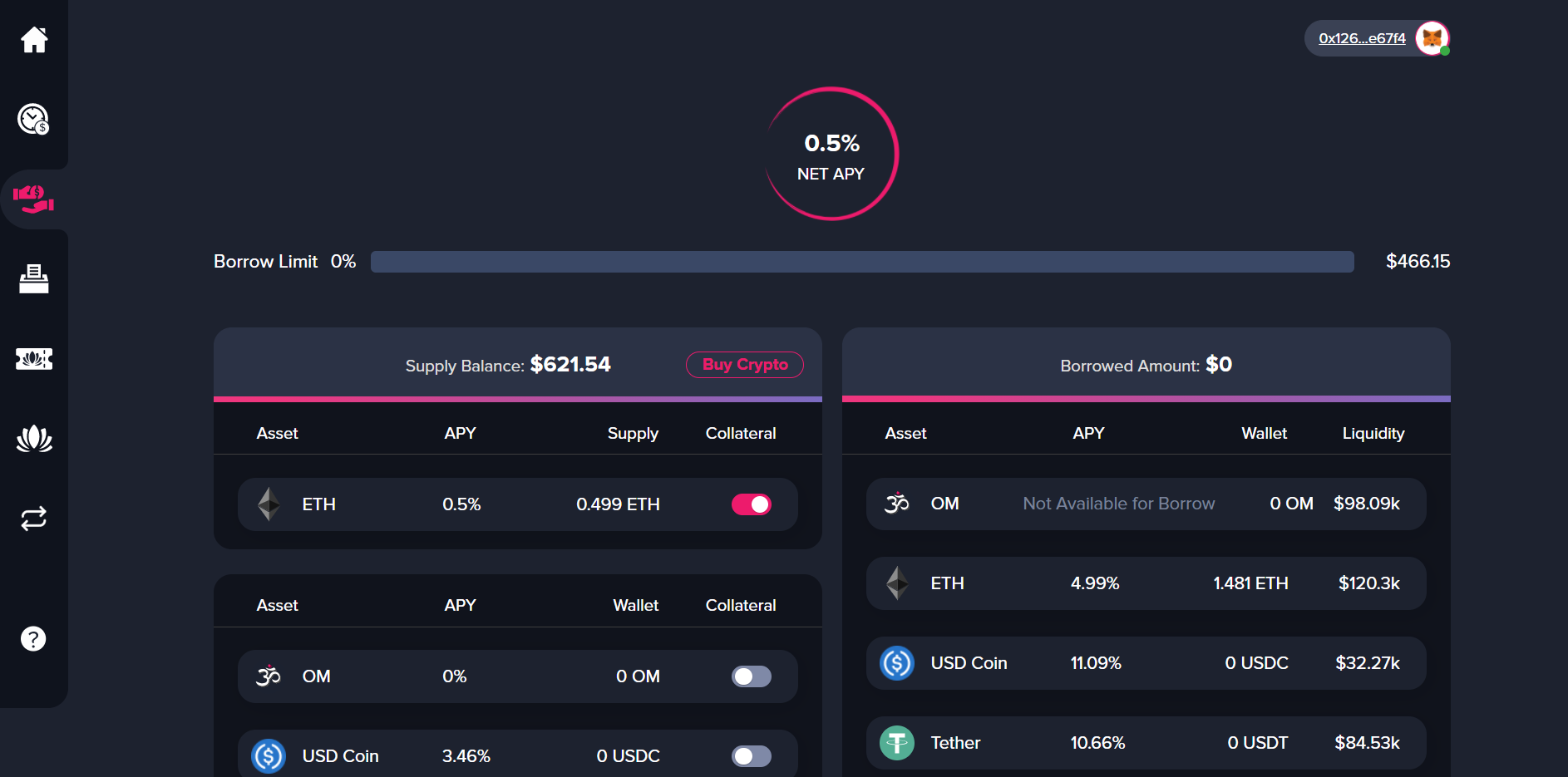

- Once the transaction has completed you can now view the supplied collateral from the main dashboard.

Withdrawing Collateral#

- To begin withdrawing collateral, click on the asset which you have supplied collateral for.

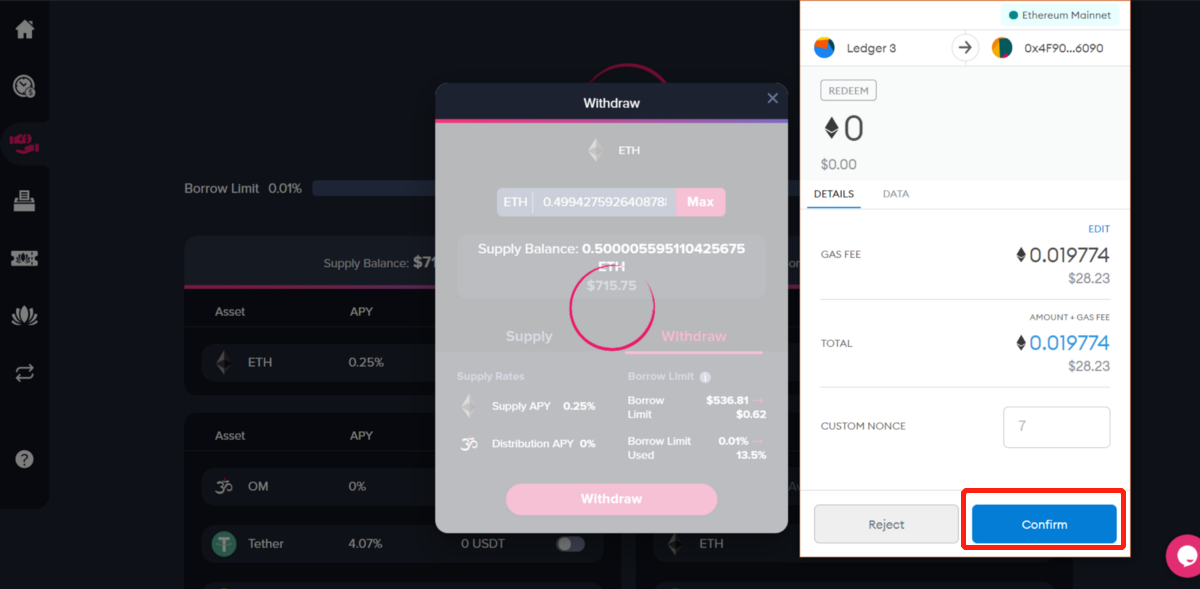

- In the input which pops up, fill in the amount you would like to withdraw, and click “Withdraw”. Here we will withdraw the entire amount.

- Complete the transaction in your browser extension wallet.

- Once the transaction has been confirmed, your collateral will be withdrawn.

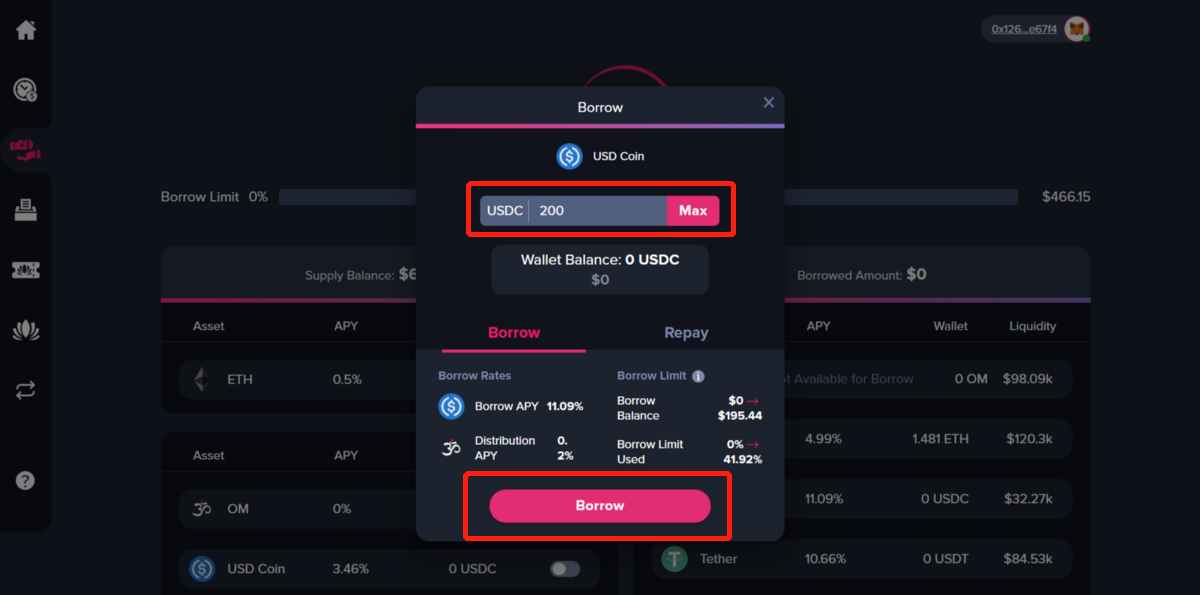

Borrowing#

- After you have supplied collateral, you will then be eligible for borrowing on that collateral. To start a borrow transaction, click on the asset you would like to borrow after having supplied collateral. Here we will click on USD Coin.

- Fill in the amount of USD Coin you would like to borrow and click “Borrow”. Note: You can see that this transaction uses up 41.92% of your borrow limit .Your borrow limit will go up and down over time as the prices of the collateral and borrowed asset change. If your borrow limit goes over 100% your collateral will be liquidated. You may need to add additional collateral to avoid a liquidation.

- Complete the transaction with your browser extension wallet.

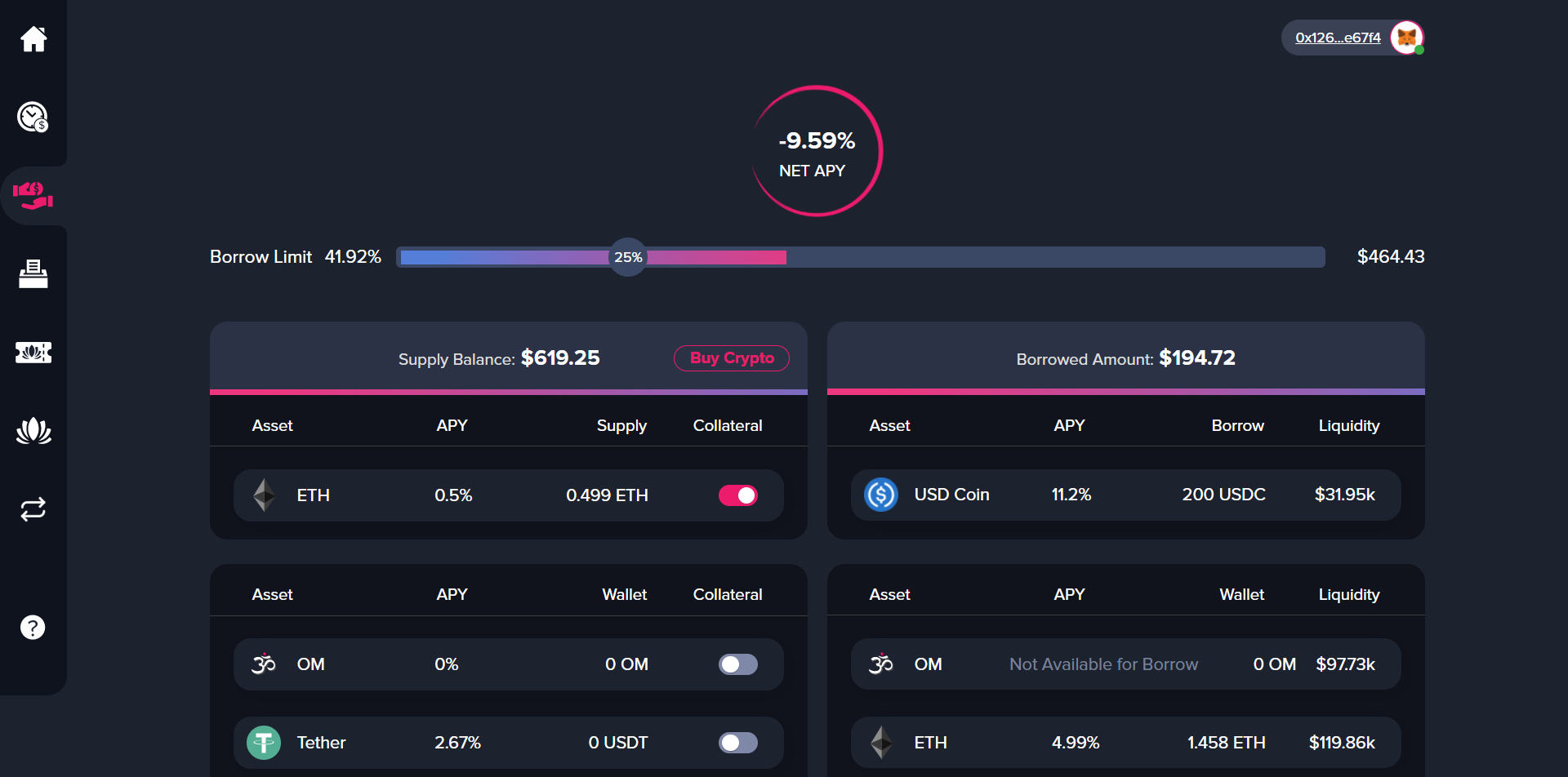

- Once the transaction completes, you can see the information about your loan and remaining borrow limit from the main dashboard.

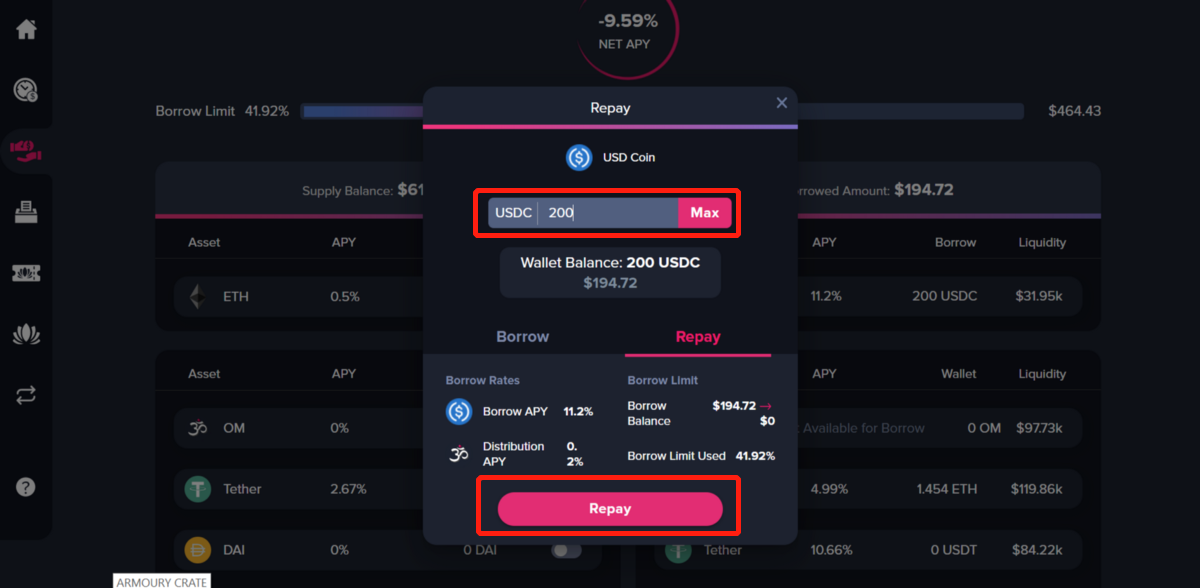

Repaying a Loan#

- To begin the repayment process, click on the asset you have borrowed from the list of borrow markets on the right. Input the amount you would like to repay and click “Repay”. Here will will repay the entire loan.

- Complete the transaction in your browser extension wallet.

- When the transaction completes, you can now see you the change reflected in the main dashboard.